QuickBooks Payroll is the most widely used application for the smooth and accurate calculation of taxes. Properly managing taxes and keeping track of all the transactions is an essential part of accounting, and QuickBooks Payroll takes care of everything.

But sometimes, the QuickBooks payroll cannot calculate taxes, leading to various problems for an individual or an organization. We’ll look at all the possible reasons and symptoms of the error. Also, we’ll discuss specific methods or solutions to eliminate the QuickBooks Payroll is Not Taking Out Taxes mistakes.

What is the “QuickBooks Payroll is Not Taking Out Taxes” Error

QuickBooks Payroll is a premier application for tax calculation, but sometimes it cannot calculate the value of taxes correctly. The “QuickBooks Payroll is not taking out taxes” error occurs when the payroll is calculating incorrect taxes or cannot figure out the taxes.

Reasons behind the “QuickBooks payroll is not taking out taxes” error.

The reasons which give rise to the “QuickBooks Payroll Is Not Taking Out Taxes” error are:

- First, the version of QuickBooks payroll might be outdated.

- Overall annual salary tops the set salary cap.

- Therefore, an employee’s latest gross wages are low.

Symptoms Behind “QuickBooks Payroll is Not Taking Out Taxes” Error

The signs or symptoms which help you in defining the “QuickBooks Payroll Is Not Taking Out Taxes” error are mentioned below:

- The final calculated sum which you receive is incorrect.

- A paycheck doesn’t have all the tax-related components.

- Therefore, the total sum displayed on the screen is zero.

Methods to Fix “QuickBooks Payroll Is Not Taking Out Taxes” Error

Following are the latest methods in order to rectify the Fix QuickBooks payroll is not calculating taxes problem:

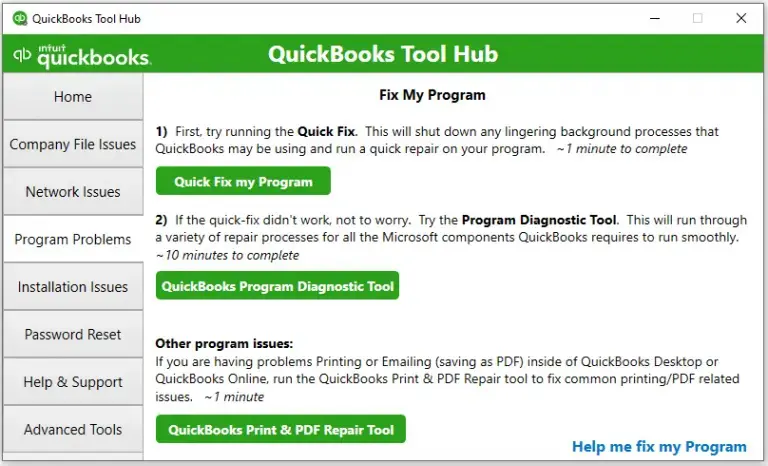

Method 1: Run the QuickBooks file doctor from the tool hub program

- First, download the latest version of the QuickBooks Tool Hub from Intuit’s website.

- Now, open the downloaded file and install the QuickBooks Tool Hub.

- After the installation, open the Tool Hub.

- Go to the “Installation Issues” tab.

- Click on the “Quick Fix My Program” option.

- Wait for 15-20 minutes until the troubleshooting is complete.

- Try to calculate your taxes again and check whether the problem is resolved or not.

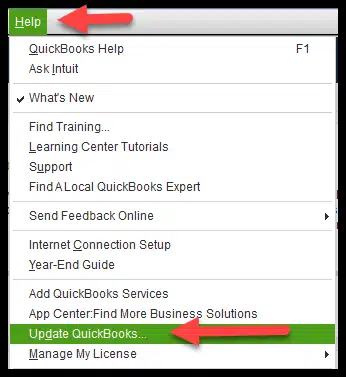

Method 2: Update QuickBooks and Payroll Tax Table to the latest update

- Open the QuickBooks Desktop application on your system.

- Go to the “Help” menu and select the “Update QuickBooks Desktop” option.

- Switch to “Update Now” and tap on “Get Updates” to download all the latest updates.

- At last, click on “Update” and sit back until the procedure is complete.

Updating Payroll Tax Table

- Go to the “Employees” tab and select “Get Payroll Updates.”

- Tick-mark the “Download Entire Update” option.

- Also, select “Download the Latest Update.”

- Wait for the successful download of the latest updates, and then restart the QuickBooks payroll.

Method 3: Revert Your Employee Paycheck

- Launch your “QuickBooks” desktop application.

- Click on the “Employees” option.

- Choose “Pay Employees” and then select “Scheduled Payroll.”

- Finally, select the “Resume Scheduled Payroll” option.

- Right-click on the “Employee’s name” and choose the “Revert Paycheck” option.

Method 4: Fix Employee Quarter or Year to Date Tax Details

- “Review the accuracy of the tax setup” in the employee profile.

- Cross-check the “Taxes Settings” for the related “Payroll Items” and are listed under the “Employees’ Paychecks.”

- You are required to check the credibility of “Payroll Items.”

Conclusion

We have discussed every detail related to the error in which QuickBooks payroll is not taking out taxes. The steps and methods mentioned here will help you resolve the error.

If you are stuck at a certain point, then feel free to connect with us, or you can also contact the QuickBooks payroll error support Team by simply writing to them at 1-800-761-1787.